Top 10 Business Tycoons in India

India’s economic landscape in 2025 is shaped by visionary leaders who have built vast empires across diverse industries. These business tycoons, through innovation, strategic foresight, and resilience, have not only amassed immense wealth but also influenced global markets. From telecommunications to pharmaceuticals, their contributions drive India’s growth as a global economic powerhouse. This article explores the top 10 business tycoons in India, delving into their journeys, enterprises, and impact on the nation’s economy, offering inspiration for aspiring entrepreneurs.

The Rise of India’s Billionaires

The collective wealth of India’s richest individuals surpassed $1 trillion in 2024, reflecting a 40% increase from the previous year, fueled by a booming stock market. These tycoons dominate sectors like technology, energy, and retail, leveraging India’s digital transformation and infrastructure growth. Their success stories, often rooted in modest beginnings, highlight the opportunities within India’s dynamic market. In 2025, their influence extends beyond wealth, shaping policy, innovation, and societal progress.

1. Mukesh Ambani: The Conglomerate King

Mukesh Ambani, with a net worth of $119.5 billion, leads as India’s richest individual. As chairman of Reliance Industries, he oversees a conglomerate spanning petrochemicals, telecom, and retail. Reliance Jio, his telecom venture, revolutionized India’s digital landscape with affordable data, boasting over 470 million subscribers. Ambani’s strategic listing of Jio Financial Services in 2023 and Reliance’s $260 billion market cap in 2024 underscore his dominance. His children, Akash, Anant, and Isha, ensure the family’s legacy, driving innovation across Reliance’s divisions.

2. Gautam Adani: The Infrastructure Giant

Gautam Adani, with a fortune of $116 billion, heads the Adani Group, a multinational conglomerate focused on ports, airports, and green energy. As India’s largest airport operator and controller of Mundra Port, Adani’s infrastructure projects are pivotal to national development. Despite a 2023 setback from Hindenburg Research’s allegations, Adani’s swift recovery, aided by a favorable Supreme Court ruling, restored his group’s market value. His son, Karan, oversees port and airport operations, signaling a robust succession plan.

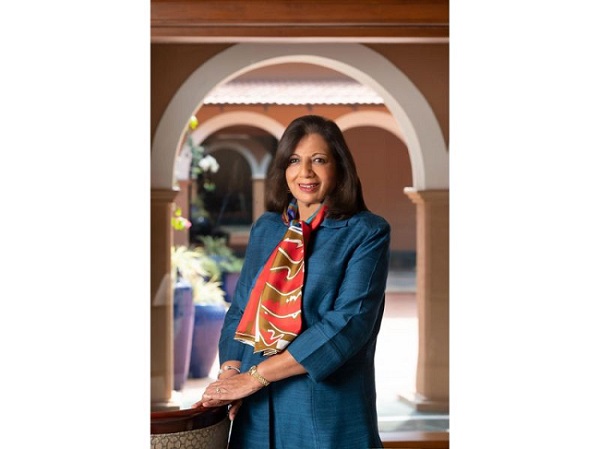

3. Savitri Jindal: The Steel Matriarch

Savitri Jindal, India’s wealthiest woman, holds a net worth of $36.3 billion as emeritus chair of the OP Jindal Group. Her four sons manage the group’s steel, power, and sports divisions, with JSW Steel being a flagship entity. Jindal’s leadership has sustained the group’s growth, navigating economic challenges while fostering innovation. Her political background and commitment to philanthropy enhance her influence, making her a towering figure in India’s industrial landscape.

4. Radhakishan Damani: The Retail Maverick

Radhakishan Damani, with $31.6 billion, transformed India’s retail sector through Avenue Supermarts, parent of DMart. His focus on low-cost, high-efficiency retail has made DMart a household name. Damani’s investments in VST Industries and India Cements, along with properties like Radisson Blu Resort in Alibaug, diversify his portfolio. Known for his low-profile approach and white attire, Damani’s strategic stock market investments continue to bolster his wealth.

5. Dilip Shanghvi: The Pharma Visionary

Dilip Shanghvi, worth $28.8 billion, founded Sun Pharmaceutical Industries, India’s first pharma company to reach a $5 billion valuation. His 2014 acquisition of Ranbaxy Laboratories for $4 billion expanded Sun Pharma’s global reach. Shanghvi’s focus on research and strategic mergers has positioned Sun Pharma as a leader in generic drugs. His hands-on leadership and commitment to affordable healthcare solidify his status as a healthcare pioneer.

6. Cyrus Poonawalla: The Vaccine Mogul

Cyrus Poonawalla, with a $25.7 billion fortune, leads the Serum Institute of India, the world’s largest vaccine manufacturer. Producing over 1.5 billion doses annually, Serum’s Covishield vaccine was critical during the COVID-19 pandemic. His son, Adar, drives modernization, including an $800 million facility for vaccine production. Poonawalla’s stakes in Poonawalla Fincorp and The Ritz-Carlton Pune diversify his empire, reflecting his entrepreneurial versatility.

7. Kumar Mangalam Birla: The Diversified Industrialist

Kumar Mangalam Birla, valued at $24.8 billion, chairs the Aditya Birla Group, a conglomerate spanning cement, textiles, and telecom. His leadership transformed the group into a global player, with UltraTech Cement dominating India’s market. Birla’s foray into telecom through Idea Cellular and investments in retail strengthen his portfolio. His strategic vision and focus on sustainability position him as a key influencer in India’s industrial sector.

8. Sunil Mittal: The Telecom Trailblazer

Sunil Mittal, with a net worth of $22 billion, founded Bharti Airtel, India’s leading telecom provider. Airtel’s extensive network serves millions, competing fiercely with Reliance Jio. Mittal’s ventures into agrochemicals and digital services, like Airtel Payments Bank, showcase his adaptability. His son, Kavin, pursues independent entrepreneurial ventures, but Mittal’s legacy in connectivity and innovation continues to shape India’s digital economy.

9. Shiv Nadar: The IT Icon

Shiv Nadar, worth $38.7 billion, founded HCL Technologies, a global IT leader serving clients like Cisco and Microsoft. His focus on software services and philanthropy through the Shiv Nadar Foundation has earned him the Padma Bhushan. Nadar’s daughter, Roshni, leads HCL Corp, ensuring the family’s influence in tech. His strategic investments and commitment to education make him

10. Azim Premji: The Philanthropic Tech Titan

Azim Premji, with a net worth of $12.transformative figure in India’s IT landscape.

6 billion, is the chairman of Wipro, a global IT and BPO leader. Known as India’s “Bill Gates” for his philanthropy, Premji’s Azim Premji Foundation focuses on education reform. His leadership transformed Wipro from a cooking oil company into a $6 billion tech giant. Premji’s ethical approach and social impact initiatives cement his legacy as a socially conscious tycoon.

Forces Driving Their Success

Several factors propel these tycoons’ success. India’s digital revolution, led by Ambani and Mittal, capitalizes on widespread internet adoption. Infrastructure growth, driven by Adani, aligns with government initiatives. Healthcare innovation, as seen with Poonawalla and Shanghvi, meets global demand. Retail and consumer trends fuel Damani’s DMart, while diversified conglomerates like Birla’s thrive on adaptability. These tycoons leverage India’s economic policies, skilled workforce, and growing consumer base to maintain their dominance.

Challenges Facing India’s Tycoons

Despite their success, these leaders face hurdles. Regulatory scrutiny, particularly in telecom and pharma, challenges Ambani and Shanghvi. Economic volatility, including inflation, impacts retail and infrastructure ventures. Adani’s past controversies highlight reputation risks. Succession planning, critical for family-run empires like Jindal’s and Birla’s, requires careful execution. Global competition and technological disruption demand continuous innovation, testing their adaptability in 2025’s fast-paced market.

Their Global and Social Impact

These tycoons shape India’s global image. Ambani’s Reliance and Nadar’s HCL compete internationally, showcasing Indian expertise. Poonawalla’s vaccines save lives worldwide, while Adani’s ports facilitate trade. Their philanthropy—Premji’s education initiatives, Jindal’s sports ecosystem, and Tata’s social work—addresses societal needs. By creating jobs and driving innovation, they bolster India’s economy, though debates on wealth inequality highlight the need for inclusive growth.

Lessons from India’s Business Giants

Aspiring entrepreneurs can learn from these tycoons. Ambani’s bold investments and Adani’s resilience underscore risk-taking. Premji’s ethics and Nadar’s focus on education highlight social responsibility. Damani’s efficiency and Shanghvi’s strategic acquisitions emphasize execution. Building a niche, as Poonawalla did with vaccines, or diversifying, like Birla, offers paths to success. Their stories prove that vision, adaptability, and perseverance can transform modest beginnings into global empires.

The Future of India’s Business Landscape

Looking ahead, India’s tycoon landscape will evolve. Emerging sectors like AI, renewable energy, and fintech will create new leaders. Succession in family-run businesses, as seen with Ambani’s children or Jindal’s sons, will shape legacies. Global economic shifts and India’s infrastructure push will favor tycoons like Adani. As digital and green economies grow, those adapting to sustainability and technology, like Mittal and Birla, will thrive, ensuring India’s prominence in global business.

Conclusion: Icons of Indian Enterprise

The top 10 business tycoons in India for 2025 represent the pinnacle of entrepreneurial success. From Ambani’s digital empire to Poonawalla’s vaccine legacy, their influence spans industries and borders. Their journeys, marked by innovation and resilience, inspire millions while driving India’s economic ascent. As they navigate challenges and embrace new opportunities, these tycoons will continue to redefine wealth, power, and impact, cementing India’s place on the global stage.